Second Quarter 2016 Key Takeaways – U.S. markets were initially range-bound for most of the quarter until June, when the relative calm in global stock markets came to an abrupt end. Upending most forecasts and taking world financial markets by surprise, the United Kingdom voted to leave the European Union on June 23. In the [...]

Behavioral Finance Reveals How Bias May Hurt Your Investing

“He must have been dropped on his head a lot when he was a child.” Clearly, we don’t often use this phrase to say that someone is a great investor. But maybe we should? Researchers have learned a lot about the human brain in the last few decades. One study from Stanford University examined how a [...]

There’s Always Room for Growth

Last month, an article “Ending America’s Slow-Growth Tailspin” by economist John H. Cochrane was featured in the Wall Street Journal. The author is a senior research fellow at the Hoover Institute – a large research think-tank out of Stanford University. This article is incredibly important because it plainly states what I have been saying for [...]

Joshua Swartz’s 5 Year Anniversary with JPH

This week marks Josh’s 5 year anniversary at JPH Advisory Group. Josh joined us directly out of college as an intern in the summer of 2011. I can still remember the office taking Josh out to lunch during his interview process and being astounded at just how mature and comfortable he was in his own [...]

Though the Jobs Report is Dismal, That’s Not the Real News

This morning a weak jobs report came out, sending stocks down and bonds up. That’s pretty normal behavior in the markets. However, emerging market stocks and bonds were actually up on the news, based on the assumption that the dollar will suffer because the Fed will be more hesitant to raise interest rates in the [...]

Are We in a Lower Return Environment?

In recent meetings with clients, we have often presented a graphic that shows the average annual returns of the U.S. stock and bond markets from 1986 to today. Why that particular 30-year time period? Because it almost exactly corresponds to my career in the investment business. It also, coincidentally, parallels a historic bull market in [...]

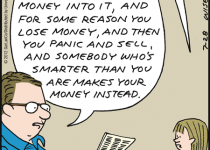

The Wrong Way to Discuss Market Volatility with Your Kids

Big Name Hedge Fund Managers Hit Hard in 2015

Some of the world’s most successful and influential hedge fund managers got their shirts handed to them in 2015. Luminous names in the industry such as Bill Ackman of Pershing Square Capital Management, David Einhorn of Greenlight Capital, Larry Robbins who founded Glenview Capital, and even John A. Paulson were several such investors, among many [...]