“He must have been dropped on his head a lot when he was a child.” Clearly, we don’t often use this phrase to say that someone is a great investor. But maybe we should? Researchers have learned a lot about the human brain in the last few decades. One study from Stanford University examined how a [...]

Our Take on Brexit and the Markets

We were as surprised as anyone with the results of the Brexit vote. In a historic decision, last Thursday the British people voted to break away from the European Union. Needless to say, this was a huge surprise to the market, the media, and the political class. (As an aside, I think that just goes [...]

Though the Jobs Report is Dismal, That’s Not the Real News

This morning a weak jobs report came out, sending stocks down and bonds up. That’s pretty normal behavior in the markets. However, emerging market stocks and bonds were actually up on the news, based on the assumption that the dollar will suffer because the Fed will be more hesitant to raise interest rates in the [...]

Full Employment: Are We There Yet?

A recent Pew Research Center poll showed that only about 19% of Americans trust their government. This is a historically low level for the measure, which shockingly at one point in the 1950s actually reached the 70% range. There are undoubtedly a myriad of reasons for this, which are beyond the scope of this post. [...]

Are We in a Lower Return Environment?

In recent meetings with clients, we have often presented a graphic that shows the average annual returns of the U.S. stock and bond markets from 1986 to today. Why that particular 30-year time period? Because it almost exactly corresponds to my career in the investment business. It also, coincidentally, parallels a historic bull market in [...]

Don’t Miss Out on Low Mortgage Rates

“It was the best of times; it was the worst of times.” Perhaps Charles Dickens’ iconic line has never been more appropriate. Twenty years from now, we may look back at 2016 and marvel at the unique set of economic forces at play: a near-zero interest rate environment on the part of nearly every developed [...]

Does Checking Your Account Daily Make You Happy?

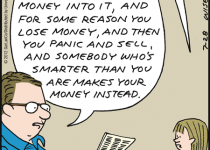

The Wrong Way to Discuss Market Volatility with Your Kids

Big Name Hedge Fund Managers Hit Hard in 2015

Some of the world’s most successful and influential hedge fund managers got their shirts handed to them in 2015. Luminous names in the industry such as Bill Ackman of Pershing Square Capital Management, David Einhorn of Greenlight Capital, Larry Robbins who founded Glenview Capital, and even John A. Paulson were several such investors, among many [...]

Nowhere to Make Money in 2015

This past year in the markets was a roller coaster ride with a remarkably tepid ending. Several big events happened globally that, in the end, disrupted just about every investment asset class, with the end result being a range between essentially a flat return for most developed equity markets, to slightly negative for most other [...]