First Quarter 2013 Key Takeaways ——

U.S. stocks posted a robust 10.6% gain in the first quarter, beating both developed international stocks at +3.8% and emerging markets stocks, which lost -3.5%. Meanwhile, the broad bond market benchmark Barclays Aggregate Bond Index was nearly flat.

Our portfolios faced market headwinds as a result of our positioning. Due to the large outperformance of U.S. stocks versus International, our International holdings hurt our portfolios in the first quarter, even though our allocation is overweighted to U.S. stocks.

On the positive side, our actively managed bond funds continued to add value relative to the core bond index (Barclays Aggregate Bond Index).

Supported by an accommodative Federal Reserve, U.S. economic fundamentals have continued to grudgingly improve. Unemployment is slowly falling, home prices have been rising, and corporate earnings and profitability are near record highs. Fed actions have also continued to support and drive strong U.S. stock market gains.

Looking ahead, significant uncertainty surrounds fiscal and monetary policy in terms of what policies will be adopted and their ultimate economic and financial market impacts. More broadly, still high global debt levels pose an economic headwind.

Against this backdrop, our outlook for US stocks has remained unchanged. If anything, given the sharp run-up in stock prices, we are getting closer to reducing our U.S. equity exposure further than we are to increasing it.

We continue to find emerging markets stocks attractive, both relative to U.S. stocks and in absolute terms over our five-year time horizon.

Most parts of the bond market offer paltry longer term return potential given our current low interest environment and we continue to favor actively managed bond funds.

First Quarter 2013 Investment Commentary

What Now for U.S. Stocks?

With U.S. stocks hitting new highs, we are naturally getting two questions from clients:

- With stocks up so much, shouldn’t we be anticipating a market correction and reduce our exposure (to lock in gains, given all of the big picture risks)?

- With stocks up so much, shouldn’t we increase our exposure and get rid of low returning assets like bonds? (since the economy must be much better than people expected)?

Our short answer to both questions right now is, no. Overall our outlook for U.S. stocks has not improved, and, if anything, given the sharp run-up in stock prices, which implies lower future returns over our five-year tactical horizon, we are getting closer to reducing our U.S. equity exposure than we are to increasing it. But let me address the above questions in order:

- Regarding anticipating correction, as we have discussed many times, we believe that a correction of 10% or more can happen at any given time for any given reason. Today, as in most times, we can see many things that could create some type of correction. Some examples of this would be the Fed suddenly changing their policies, a banking crisis in Europe, or political tensions around the world from the Middle East to North Korea; any of which could cause a correction in the U.S. However, history tells us that we can go a long time without any significant corrections at all. In the 1990s, we went 8 years with no correction of 10% or more. We do not know what will cause the next correction or when it will happen—and neither does anyone else. That is the primary reason why we do not make adjustments in our allocations based upon a potential correction.

- Should we increase our allocation to stocks given that they are doing so well? That goes back the level of risk you are willing to assume in your portfolio, otherwise known as your risk tolerance. In other words, how much risk will allow you to reach your goals while also not disrupting your “sleep at night” factor. When we have discussions on risk and asset allocation with clients, the decision has nothing to do with the market. The market should not change one’s risk tolerance. The markets will determine how we manage your portfolio based on your risk tolerance, but it shouldn’t change your personal risk tolerance. At the end of the day, if bad things happen and stock markets tumble, your best defense is high quality bonds – even with a 2% yield on the 10-year treasury.

Given the current environment we are in, what do we do? To some extent, we hedge our bets as we always have. This is diversification and is simply the prudent course in an environment this uncertain. We are constructing portfolios that we believe should perform reasonably well across a range of potential outcomes, any one of which we believe has reasonable odds of actually playing out. But if one of the more extremely negative or positive scenarios unfolds, our portfolios are not going to do as well (at least over the shorter term) as a portfolio that has made a big bet on that particular outcome. Of course, if a particular extreme scenario doesn’t happen, then those extremely positioned portfolios would experience commensurately poor performance. We don’t think making a big bet on an outcome that can’t be determined with confidence is in the best interests of our clients.

The Environment: Policy Uncertainty and Modestly Improving Economic Fundamentals

A major contributor to the uncertainty that we face in today’s environment surrounds government policy, both fiscal and monetary. The ultimate economic and financial market environment depends largely on which policies are adopted. With respect to fiscal policy, in the first quarter the markets digested the sequester’s spending cuts without much drama. However, the sequester’s impact (estimated at around a 0.6% hit to GDP growth in 2013) is small potatoes compared to the debt and fiscal policy challenges that still confront the nation. Although we would agree that there is not an immediate federal budget deficit crisis, there is clearly a debt/deficit crisis, at least in the medium to longer term given the mismatch between federal revenue and spending. This calls for a strong and credible longer-term fiscal policy response and the sooner the better. We won’t hold our breath, but maybe our political leaders in Washington are starting to get the message. If so, that could be a major positive catalyst for both the financial markets and the real economy. On the other hand, it may yet take a crisis to create the political will necessary to implement meaningful structural fiscal changes.

On the monetary policy side, there is more clarity at least in terms of the policies already in place. The leadership of the Federal Reserve (Chairman Ben Bernanke and Vice Chair Janet Yellen, among others) continue to be very vocal in stating that the Fed is not close to starting to unwind their stimulative policies, which involve purchasing $85 billion per month of Treasury bonds and mortgage-backed securities (quantitative easing) and holding the federal funds policy rate near zero percent. But there is significant uncertainty as to the medium to longer term ramifications and unintended consequences of these policies and whether or not the Fed’s ultimate exit plan will be executed successfully and without collateral damage. Based on the Fed’s historical record of policy overshooting—and just the inherent complexity of the task at hand for anyone to get it right without a lot of luck—most, including us, are skeptical.

In the meantime, Fed statements and actions continue to be an important support and driver of short-term stock market performance. While central bank actions have always influenced the stock market, the markets appear particularly attuned to and reliant on ongoing highly accommodative Fed policy. Again, over the near term, we don’t see any catalyst for Fed policy to become restrictive. So that leg of support to the markets is likely to remain in place. But the uncertainty increases as the time horizon extends, and our confidence in our ability to be “ahead of the market” in assessing a change in Fed policy and repositioning our portfolios accordingly is very low.

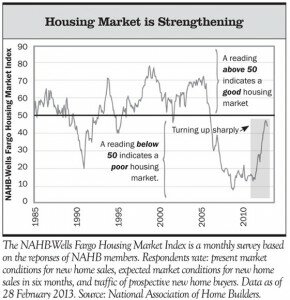

Supported by accommodative monetary policy, U.S. economic fundamentals have continued to grudgingly improve. The unemployment rate continues to fall slowly—although that’s partly driven by a particularly sharp drop in the labor force participation rate (meaning there are fewer people working or seeking work.) The housing market is strengthening (although mortgage lending to households remains tight) and household wealth is growing (driven by stock market and housing price gains), which is a key goal of the Fed’s QE program. Finally, corporate earnings and profitability are around their all-time highs. However, our concerns about the impact of global debt deleveraging on economic growth and corporate profits remain.

Supported by accommodative monetary policy, U.S. economic fundamentals have continued to grudgingly improve. The unemployment rate continues to fall slowly—although that’s partly driven by a particularly sharp drop in the labor force participation rate (meaning there are fewer people working or seeking work.) The housing market is strengthening (although mortgage lending to households remains tight) and household wealth is growing (driven by stock market and housing price gains), which is a key goal of the Fed’s QE program. Finally, corporate earnings and profitability are around their all-time highs. However, our concerns about the impact of global debt deleveraging on economic growth and corporate profits remain.

Outlook for U.S. and Foreign Stocks

When I started in this business in 1985, foreign stocks were not something that were in most client’s portfolios. However, somewhere in the 1990s it became standard industry practice to allocate about 20% of a portfolio internationally, and today the perception of International stocks as a part of a portfolio is much more widely accepted. The average “normal” allocation of International stocks today is probably somewhere between 30-40%. As our clients and reader’s of our newsletter know, we have had allocations to International markets in the low 20% for the last 4 years. Since the U.S. has significantly outperformed the International markets, this has been a tremendous benefit for our clients and has accounted for significant outperformance. As the returns of U.S. and International markets continue to diverge, it is more likely that we will rebalance our portfolios to a more traditional allocation between U.S. and International stocks. We have been asked repeatedly when we plan on doing that and while we don’t know the exact timeframe yet, given the divergence that occurred in the first quarter, we are certainly closer to that rebalancing.

Update on Bond Markets and Fixed-Income Positioning

The big picture bottom line is that the fixed income marketplace, particularly the highest quality parts, continues to offer paltry longer term returns. Most areas of fixed income are trading at historically elevated prices, and yield levels are at or near historic lows.

What this means in terms of our fixed income positioning is that our balanced portfolios remain heavily underweight to core investment grade bond funds, at slightly under half of our strategic target weighting. In their place we have large allocations to flexible and absolute return oriented bond funds that we expect to outperform the core bond index (and core bond funds) across our five year scenarios.

Concluding Comments

Investing is a marathon, not a sprint. The key is to maintain discipline. We can analyze the longer term with far greater confidence, and invest accordingly, but realizing the benefits demands the discipline to ignore inevitable shorter term gyrations that are impossible to predict with consistency. Succumbing to the temptation to jump into “what’s working” based on a recent run of outperformance is a path to disappointment and subpar long-term investment results.

As always, we will continue to work our hardest to make the best investment decisions we can on your behalf, taking into account your long-term financial goals and the level of risk you can accept.

Sincerely,

Jon Houk, CFP®