First Quarter 2014 Key Takeaways –

Global markets experienced an up and down quarter but ended mostly positive despite developments such as Russia’s annexation of Crimea, further evidence that China’s growth is slowing amidst government efforts to manage a potential credit bubble, the changeover in Federal Reserve leadership, and a general continuation of the slow economic recovery in the United States and Europe.

In terms of U.S. economic growth, the quarter’s progress was complicated by severe winter weather that likely depressed some of the short-term indicators of the economy’s health. Overall, though, the picture remains one of modest, but steady economic growth with a noteworthy rebound in housing alongside persistently slow to recover employment. U.S. stocks cooled from last year’s pace but posted small gains for the quarter.

Developed international stocks were flat, largely due to a sizeable decline in Japan, where a new sales tax is the latest uncertainty as the country tries to achieve sustainable growth and healthy inflation. Amidst slow growth but still high unemployment and very low inflation (and deflation fears), many European markets rose.

Emerging markets have been beset by ongoing concerns about economic growth alongside macroeconomic instability in countries such as Ukraine (most recently) and Turkey. These issues have been a headwind over the past year and led to a small first quarter loss for emerging-markets stocks (though our actively managed emerging-markets funds were positive).

Core bonds were among the quarter’s stronger performers, reinforcing the important role they play in a diversified portfolio. Municipal bonds were another bright spot in the quarter amidst improving economic health for states and municipalities.

It is important to note a distinction between the short-term news and information that seems to drive markets day to day (and over any given quarter) and the longer-term analysis that underlies our five-year scenarios and asset class return models. While we pay attention to the shorter-term information and its effect on markets, we aren’t apt to make adjustments to our longer-term views solely as a result of these developments.

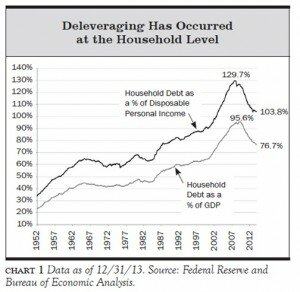

Our analysis indicates that the household debt deleveraging process has progressed at a slightly faster pace than we expected. This is good news for the economy and maybe, just maybe, the economy will move from “muddling along” to a more normal recovery and high GDP growth.

Even with the good news on household debt, we remain mindful that we have not yet achieved “normal” economic status; specifically, we remain skeptical as to how the Fed will unwind its huge balance sheet and normalize interest rates without major market disruptions and how China manages its credit and infrastructure bubble.

Turmoil in the emerging markets over the past year has led us to revisit our investment thesis there as well. While we maintain a favorable long-term view of the emerging markets asset class, we have lowered our long term return expectations slightly.

Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by JPH ADVISORY GROUP with permission. Reproduction or distribution of this material is prohibited and all rights are reserved.First Quarter 2014 Investment Commentary

The Overall Investment Thesis of Deleveraging

In our recent commentaries we’ve noted the significant improvement in household balance sheets (total net worth), driven by both a strong rebound in housing prices as well as a surging stock market. We have also noted many other improvements in the U.S. economy and the broader macro environment over the past year. These developments served as a catalyst for us to reassess the progress of our deleveraging thesis. Upon our review, we have concluded the following:

In our recent commentaries we’ve noted the significant improvement in household balance sheets (total net worth), driven by both a strong rebound in housing prices as well as a surging stock market. We have also noted many other improvements in the U.S. economy and the broader macro environment over the past year. These developments served as a catalyst for us to reassess the progress of our deleveraging thesis. Upon our review, we have concluded the following:

- The deleveraging process is still ongoing, though it is probably progressing at a slightly faster pace than we expected. This is good news for the economy.

- While median incomes have not gone anywhere in real (inflation-adjusted) terms, the key to any smooth deleveraging is that nominal incomes do not decline. On that front, the stimulative monetary and fiscal policies we have seen since the crisis have worked well so far. And should the economic recovery continue, we would expect at least some improvement in household income growth. Moreover, household balance sheets have improved significantly as the housing and stock markets have risen and household net worth is now higher than pre-crisis highs.

- Largely due to the Federal Reserve’s QE policies, which make holding cash or safe assets with very low yields extremely painful for investors, we have not seen the high levels of risk aversion we expected would occur during a deleveraging process. With the Fed’s commitment to gradually tapering QE and keeping rates low until unemployment and inflation reach levels they believe reflect a healthy economy, we believe most of the private sector deleveraging headwinds are now behind us.

But We Have Not Yet Achieved Normal Status

In investing, there is always something to worry about. However, with a long investment horizon, which we have, things generally turn out fine. In normal times we’d generally be optimistic about the economy and the markets, but we are living in a period without historical precedent. We are still in the midst of an unprecedented monetary policy experiment, which has resulted in the Fed having a huge balance sheet. How that unwinds, or whether or not it will even fully unwind, and how the Fed will normalize interest rates such that lenders once again have an incentive to lend to productive investments are big unknowns, and they introduce considerable uncertainty. The Fed’s creative monetary policy experiment (or QE) thus far has led to a surprisingly benign deleveraging process. For that we feel fortunate and thankful. But we worry that the steps taken to make the deleveraging process benign may have unintended consequences that neither we nor anyone else, including the Fed, can fully understand or anticipate.

One key question we struggle with is, can the Fed unwind its huge balance sheet and normalize interest rates without major disruptions in the markets? We observe two main sets of views on this among investors and other market participants. One group, and this seems to be the majority, sees it as a huge uncertainty and an unknowable risk. The other group offers a benign view and suggests the Fed has the tools to accomplish its goals without a major impact on the markets and/or the real economy. While it’s possible the Fed can have its cake and eat it too, it’s hard for us to gain conviction in this benign view or to base investment decisions on it. We think this is a risk we should factor into our decision making, at least until we better understand the new era of monetary policy the Fed seems to be embarking upon. Even though we see a much better environment for equities/stocks, given the above concern, we are not ready to increase risk in our portfolios.

As a related point, much of the private sector deleveraging has been accomplished by shifting debt from the private to the public sector. As such, overall U.S. debt levels remain uncomfortably high. There are a few reasons why it may not be as big a concern as private sector indebtedness, at least not in the near term. First, the United States, through its privilege of being the world’s reserve currency, is still a preferred destination for the world’s savings, which are in excess supply. This gives the United States greater flexibility to manage its deleveraging and to grow out of its indebtedness. Second, the fiscal deficit has turned down and debt is no longer growing faster than nominal GDP growth (it is amazing what holding spending down for a few years can do). There still needs to be long term changes in entitlement spending in Washington if we are to make any progress on reducing public debt.

Revisiting Emerging Markets

Our concerns related to China have increased slightly, and the turmoil in emerging markets overall over the past year has led us to revisit our investment thesis. In hindsight, emerging-market countries in aggregate do not have as much control over their monetary policies as we had thought. The past year has also reinforced the safe-haven status of the United States and the privilege it commands as a result of being the world’s reserve currency. Emerging markets, despite their better balance sheets and better long-term fundamentals, remain susceptible to short-term capital outflows. Because these outflows can contaminate emerging-markets fundamentals, and we cannot know when sentiment will worsen and when outflows will occur, the risks we perceive with emerging-markets investing are slightly higher than they were a year ago. To be clear, we still do believe emerging-markets will provide higher returns over the next three to five years, but not without higher risk.

A Quick Update on our Broad Economic Scenarios

Our review of our deleveraging thesis also led us to recalibrate our broad economic scenarios. The goal is to gain a qualitative sense of investment regimes we may experience and how best to position our client portfolios such that the odds are high they meet their risk and return objectives across a range of probable environments. Below we list three main scenarios we think are probable based on our reassessment. We also consider other scenarios not listed below as part of our sensitivity analysis and stress testing of portfolios and asset class expected returns.

- Bear: The economy falls into recession for any of various reasons, such as deleveraging/deflation from Europe or China, unexpected systemic shock, Fed policy error, etc. This scenario does not assume another severe financial crisis, i.e., not a repeat of 2008–2009. Key assumptions: corporate earnings are below trend; inflation is around 1.5%; and the 10-year Treasury yield is around 2.5% at the end of year five.

- Base: Moderate economic recovery continues with no major crisis, but a normal recession is likely within the five-year time horizon. GDP growth rates and interest rates start to “normalize” toward the end of our five-year horizon. Key assumptions: inflation is around the Fed’s target of 2%–2.5%; the Fed slowly raises rates; the 10-year Treasury yield is in a range around 4% at the end of year five.

- Bull: U.S. economic growth is above average and/or earnings end the period above the long-term trend line. A self-reinforcing global growth cycle develops, helped by stronger non-U.S. growth, re-leveraging of the U.S. consumer, and corporate investment spending. Key assumptions: inflation increases but remains relatively mild largely because wage pressures remain subdued due to technology and globalization forces; the Fed exits its accommodative policy without major economic or market disruptions, although a normal recession within the five-year period is still possible; the 10-year Treasury yield is in a range around 6% at the end of year five.

Concluding Thoughts

Five years after the worst financial crisis since the Great Depression, we feel fortunate to be where we are. The overall economy and our client portfolios are in much better shape than the investment pundits would have led us to believe. Yes, there are still many problems and a laundry list of concerns and uncertainties. The question we always ask is, how material are these risks and what is the likelihood of them playing out? In our minds, a disruptive deleveraging process was a risk scenario we felt was prudent to protect our clients against. By definition, if a risk scenario we were insuring against does not pan out, there will be a cost. However, it can be recovered over the longer term from other investment decisions we make at the portfolio level, and we have made up quite a bit already. At present the biggest risk in the US equity markets is valuation risk. Stocks are not egregiously expensive (yet), but they are definitely not cheap.

We have frequently written about our focus on generating absolute returns and mitigating downside risk rather than reaching for relative returns. Many strategists, even some we respect, would overweight stocks at a much lower return hurdle, citing very low interest rates. But that stance does not adequately factor in equities’ higher absolute downside risk in our opinion. Also, rates will eventually normalize: even if we don’t know precisely when, we still have to prepare our portfolios for the possibility of what will happen when they do. Moreover, in the current period of extremely low bond yields where there isn’t a lot of cushion against a recession or an economic shock, the need to insure against downside risks is greater than when yields were higher. Ultimately our asset class weightings—and, specifically, our willingness to take on equity risk—rest on our view of return and risk potential for the asset class as well as the objectives and risk threshold of each portfolio. These are our foremost, and ongoing, considerations as we manage our portfolios and work with our clients to achieve their goals.

Sincerely,

Jon Houk, CFP®