source: www.cityam.com

I want to highlight a recent story about a tax experiment going on in Europe, because it’s a classic example of the disconnect between tax projections and actual reality. Real life tax policy doesn’t occur in a vacuum; instead, people change their behavior whenever new taxes are introduced. Hungary, France, and Italy have all implemented new “financial transaction taxes” (FTT), which simply is a small percentage tax on each purchase or sell of financial securities. In each case, the revenue these FTT generated was far below the amounts promised. Given the opportunity, investors will simply change their behavior by making the same transactions on a different country’s stock exchange.

The bigger point, I believe, is that any time a politician claims that this or that new tax will generate a certain level of revenue, we can be justifiably skeptical.

Transaction Tax Missing Its Targets

by Tim Wallace

TOUGH taxes on financial transactions across Europe have devastated market activity and failed to raise as much as politicians hoped, according to new figures out yesterday.

Hungary implemented a 0.1 per cent tax at the start of the year.

But it raised less than half the revenue the state had hoped for, bringing in 13bn Hungarian Forints (£36m) in January.

The poor showing comes as 11 EU countries push to implement a financial transactions tax (FTT) on shares, bonds and derivatives.

France forged ahead on its own, introducing a 0.2 per cent tax on sales of shares of major firms. But that only raised €200m (£169.4m) from August to November, well below to €530m expected.

And Italy launched its FTT this month. Figures from TMF Group suggest it has cut trading volumes by 38 per cent already, while German and Spanish volumes rose.

“The introduction of FTT in Hungary is not going as planned, and many of the assumptions promoted by the proponents of the EU-11 regime will be put into question,” said TMF Group’s Richard Asquith.

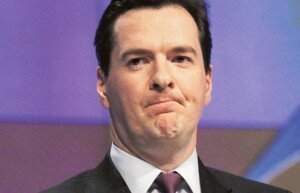

The UK opposes the plan with chancellor George Osborne arguing trading will move overseas unless any such tax is global rather than restricted to the EU only.