We were as surprised as anyone with the results of the Brexit vote. In a historic decision, last Thursday the British people voted to break away from the European Union. Needless to say, this was a huge surprise to the market, the media, and the political class. (As an aside, I think that just goes [...]

Though the Jobs Report is Dismal, That’s Not the Real News

This morning a weak jobs report came out, sending stocks down and bonds up. That’s pretty normal behavior in the markets. However, emerging market stocks and bonds were actually up on the news, based on the assumption that the dollar will suffer because the Fed will be more hesitant to raise interest rates in the [...]

Full Employment: Are We There Yet?

A recent Pew Research Center poll showed that only about 19% of Americans trust their government. This is a historically low level for the measure, which shockingly at one point in the 1950s actually reached the 70% range. There are undoubtedly a myriad of reasons for this, which are beyond the scope of this post. [...]

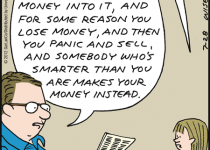

The Wrong Way to Discuss Market Volatility with Your Kids

Market Update from JPH Advisory

As I’ve said many times in the past, “the market can go down 10% at any time for any reason or for no reason at all.” Unfortunately, over several days in late-August, I was proven right. Volatility has returned with a vengeance to equity markets after almost 4 years without a correction (i.e. a market [...]

Protect Your Identity Online (Part Three)

Step Three: Start Fighting Back This is my third and final post about “Protecting Your Identity Online.” As you’ll recall from the previous posts, the number one way to protect yourself is a “credit freeze,” and knowing your rights and options if you are victimized is vital (since there is a very high probability that most people will be hit at some [...]

Protect Yourself from Identity Theft (Part One)

Step One: Freeze Your Credit, and Help Leave Fraudsters Out in the Cold According to the Justice Department’s latest statistics, approximately 7% of U.S. adults can expect to experience some form of identity theft this year. That’s one in every 14 people. And according to the FTC it takes an average of about six months [...]

Income Inequality the Wrong Focus

The president has called it the “defining challenge of our time.” And he is not the only one focusing on “income inequality.” A simple Google Trends chart (below) shows how interest in that search term has increased significantly over the past few years. But what disturbs me about the focus on “income inequality” and similar [...]

Is ‘Free File’ Really Free?

I came across an article recently in The Wall Street Journal by Laura Saunders discussing the limitations of the Federal program ‘Free File’, and my interest was piqued. I have long been an advocate for anything labeled ‘free’, and have taken some heat from friends in recent years for the number of hoops I am [...]

5 Tax Breaks Just Renewed by Congress

In an article yesterday in the Wall Street Journal, Laura Saunders gave five important tax breaks that are being extended to 2014. These provisions had expired as of January 1, 2014, but it was widely expected that Congress would eventually choose to extend them, as they have for each of the last few years. As usual, Congress [...]